Key Points :

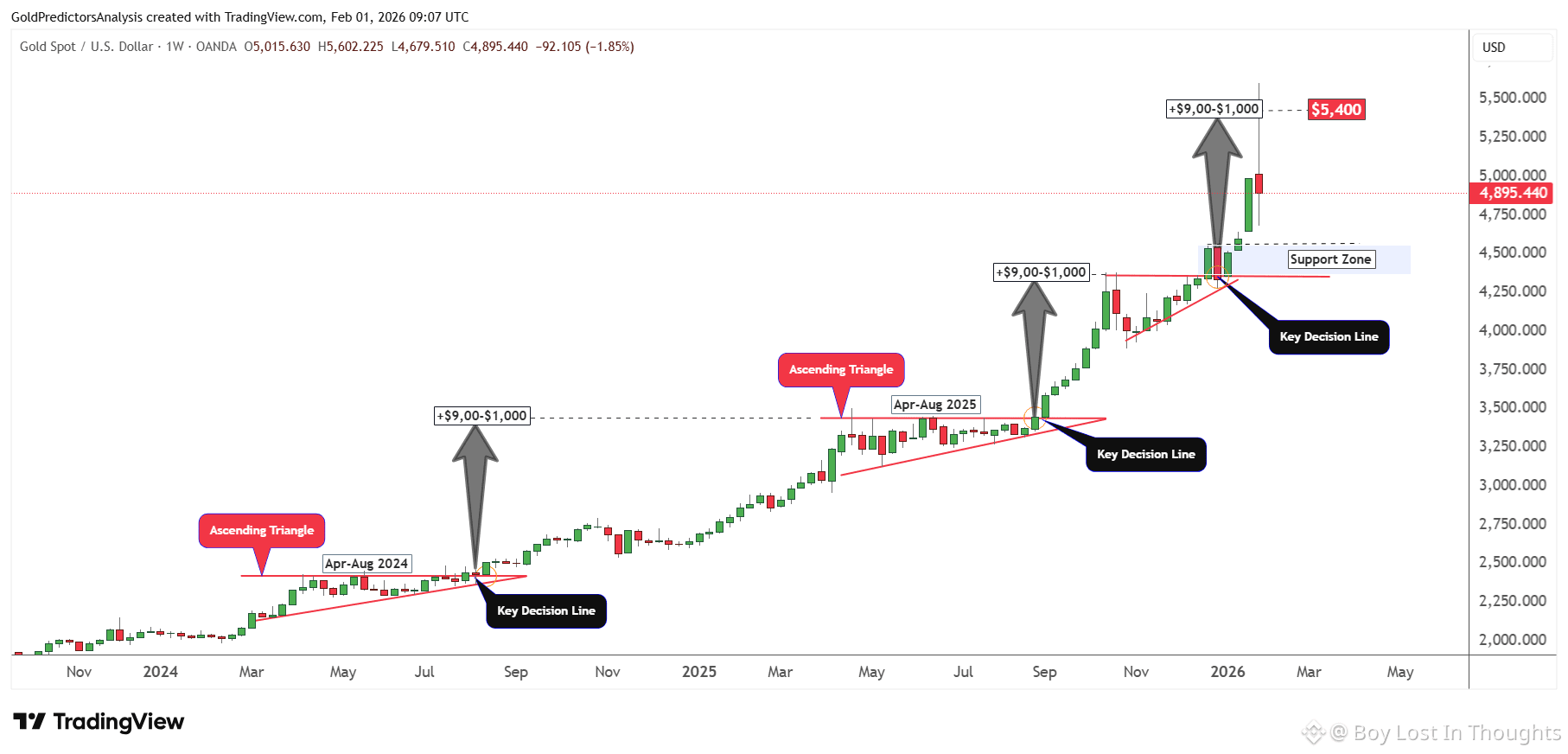

Sharp Correction, Not Trend Reversal: Gold's drop from a $5,600 high (over 10%) is framed as a market reset after an extended rally, not a break in the long-term bullish trend.

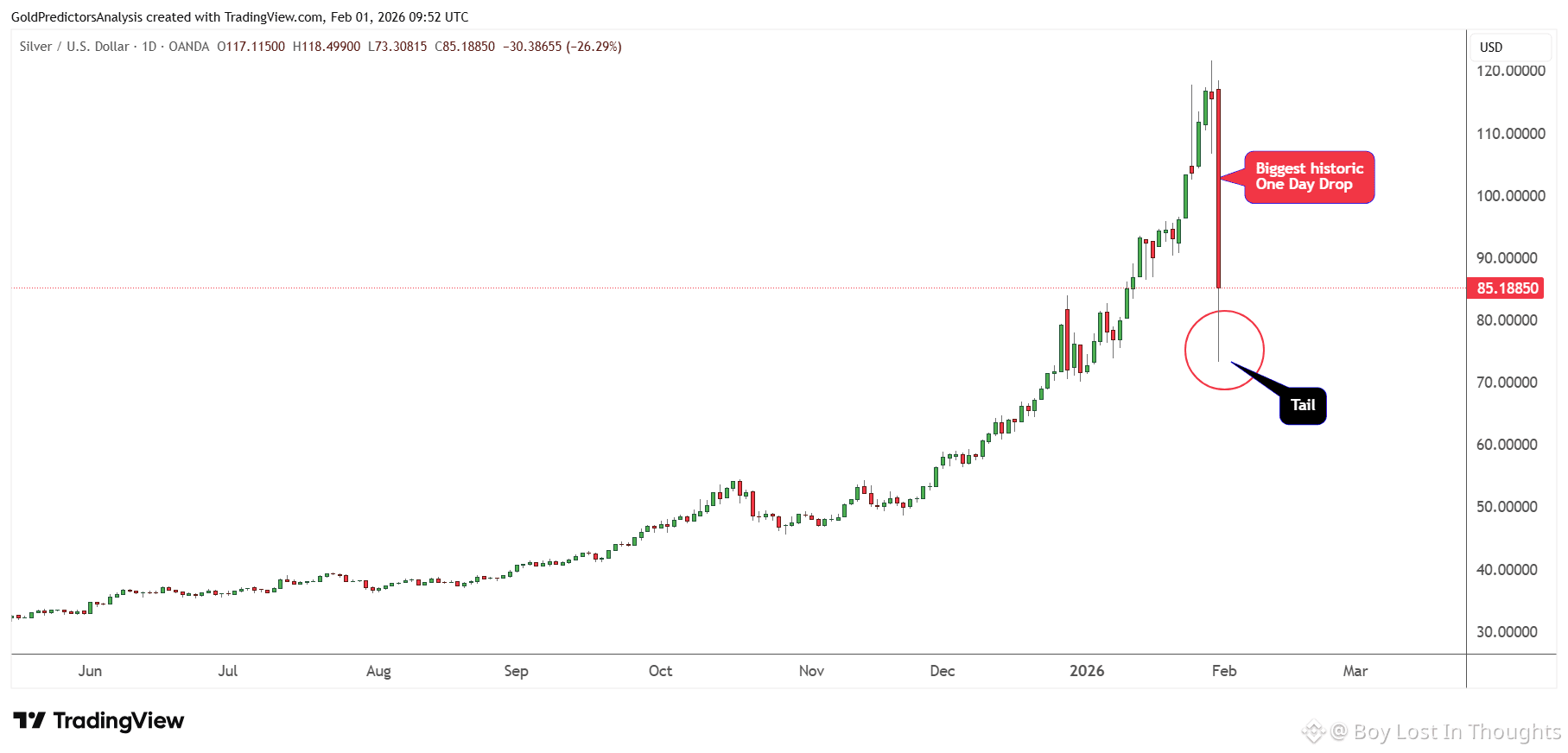

Trigger: Fed Chair Nomination: The selection of Kevin Warsh as the next Federal Reserve Chair caused a short-term "risk-off" shift, triggering immediate, sharp declines across precious metals (Silver -27%, Platinum -17%) and critical materials.

Critical Support Level: The $4,000 level is the key technical floor. As long as gold holds above it, the bullish structure remains valid. A decisive break below this level would signal risk of a deeper pullback.

Underlying Drivers Remain: The fundamental reasons for the long-term rally—geopolitical tension, fiscal instability, supply risks for critical materials, and sustained central bank buying—are unchanged by this news-driven correction.

A Healthy Pause: The analysis concludes this volatility is a "healthy correction" that sets the stage for gold's next rally once the immediate reaction settles.