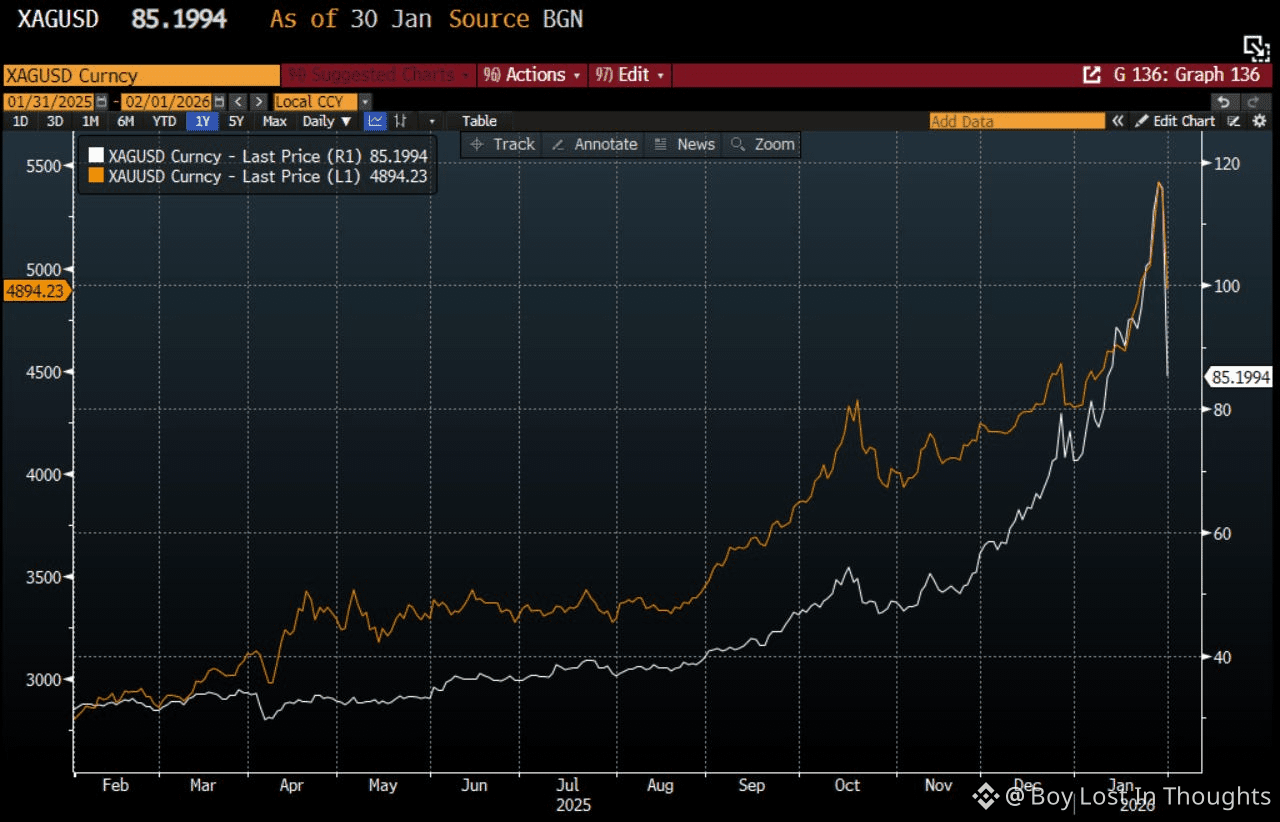

Friday’s dramatic drop in gold and silver does not signal the end of the debasement trade. Instead, the trade—sparked by the Fed’s dovish pivot in 2025—remains firmly in place. Soaring public debt and political pressure for rate cuts continue to drive investors toward safe havens. Despite volatility, markets interpret Kevin Warsh’s nomination as Fed Chair as dovish, and the recent pullback only retraced a few weeks of gains. Expect the debasement trade to strengthen as fiscal trends and Fed policy sustain it.

Key Points:

Policy Drives the Trend: The "debasement trade" began after Fed Chair Powell’s August 2025 Jackson Hole speech, where he prioritized the labor market over inflation—signaling easier monetary policy despite high inflation.

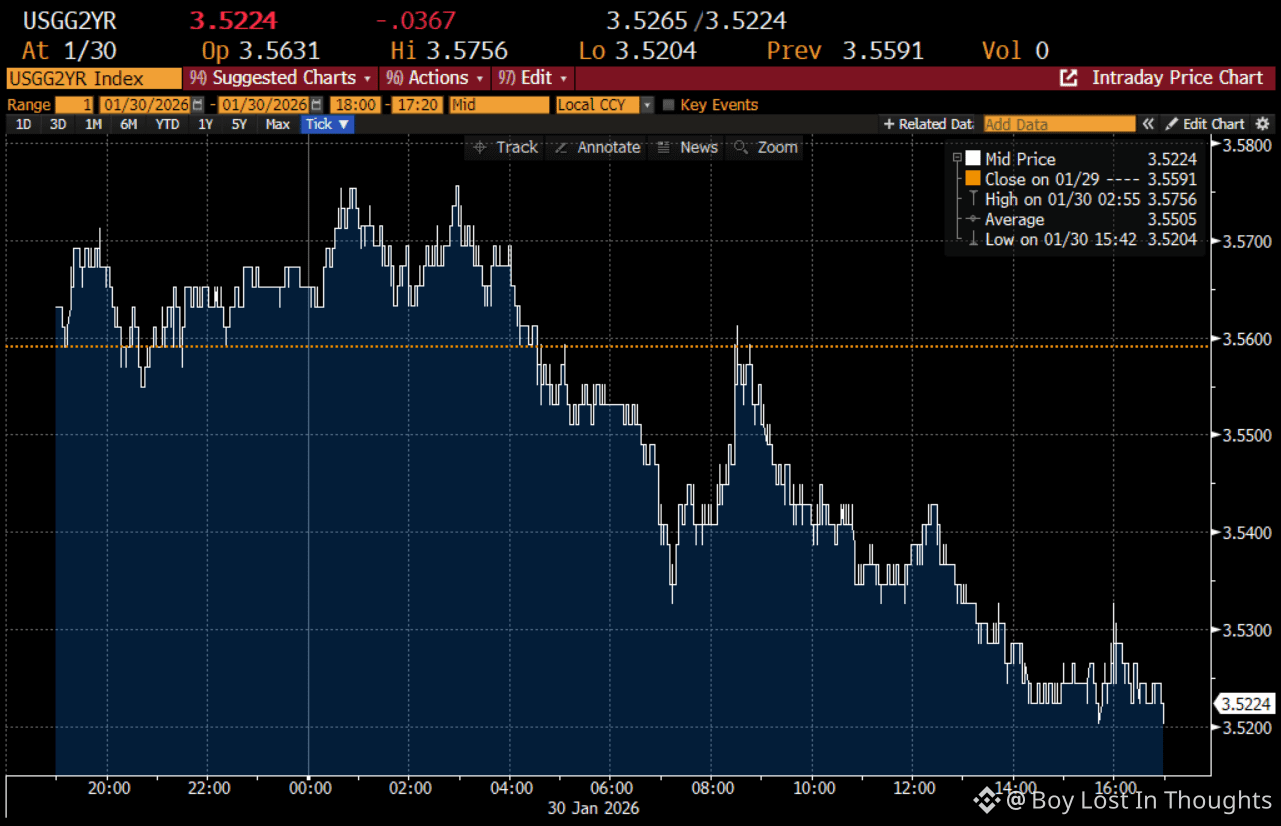

Fiscal Reality Persists: High and rising public debt continues to push up long-term yields, increasing political pressure on the Fed to cut rates and monetize debt—fueling the search for safe havens.

Warsh Doesn’t Change the Game: Markets see Trump’s Fed Chair nominee Kevin Warsh as dovish, pricing in more rate cuts after his nomination—a bullish signal for the debasement trade.

Friday’s Plunge is Minor in Context: Despite sharp drops (silver -26%, gold -9%), prices only retreated to mid-January levels, barely denting the massive recent rally.

Outlook Remains Intact: The trade is expected to resume quickly, similar to the rebound after October’s correction, as fiscal and monetary pressures continue.