The Bank of Japan's Policy Board members met in January 2026 to discuss the economy and monetary policy. While the Japanese economy is recovering moderately, its growth is uneven. Globally, accommodative policies and booming AI investment are expected to help the world economy enter a recovery phase this year.

A key focus was on inflation. The main driver of price increases is now shifting to personnel expenses (wages), making inflation "sticky." Members noted that if upcoming wage negotiations, price trends, and inflation expectations align with the Bank's outlook, it could be judged as early as this spring that the underlying price trend has sustainably reached the 2% target. The persistent depreciation of the yen is also a significant concern, as it pushes up prices for both imports and domestic goods, potentially widening inequality by affecting large and small firms differently.

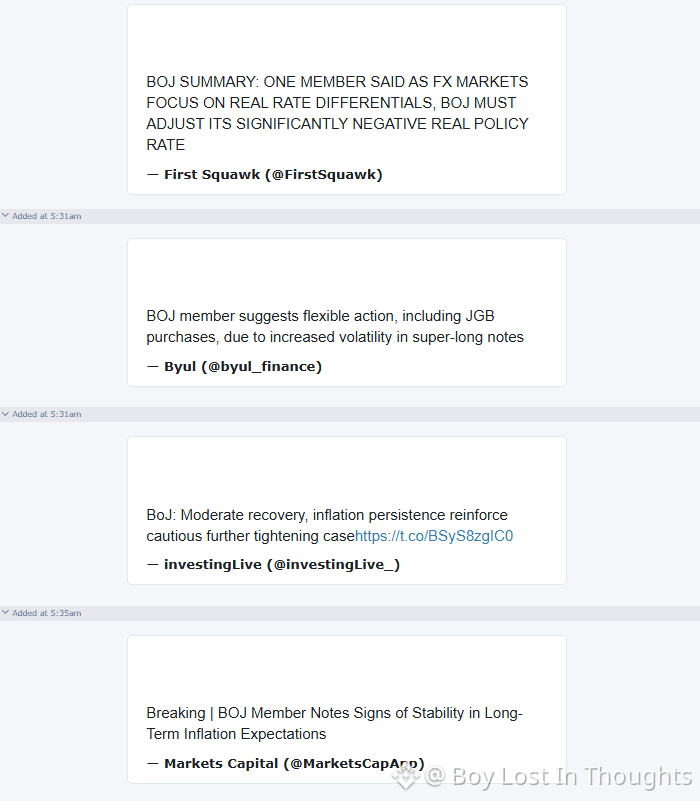

Regarding monetary policy, opinions converged on the need for further interest rate hikes. Members agreed that financial conditions remain accommodative despite a rate hike in December 2025 and that real interest rates are still very low. There is a strong consensus that the Bank must continue to raise the policy interest rate in a timely manner—potentially at intervals of a few months—to adjust the level of monetary easing and avoid "falling behind the curve," especially if overseas interest rates change.

Key Points

Inflation Target in Sight: Underlying CPI inflation is rising moderately. The main driver has shifted to wages, and inflation is becoming "sticky." A sustainable achievement of the 2% price stability target could be confirmed as early as spring 2026.

Yen Depreciation is a Double-Edged Sword: The weak yen boosts profits for large exporters but hurts small and medium-sized firms and pushes up import prices. This contributes to inflation and could widen economic inequality.

Further Rate Hikes Are Coming: Despite a hike in December 2025, financial conditions are still accommodative. The consensus is clear: the Bank of Japan should continue raising the policy interest rate in a timely and appropriate manner to adjust monetary easing.

Risk of "Falling Behind the Curve": Policymakers emphasized the importance of acting carefully yet promptly. With Japan's real policy interest rate among the lowest globally, there is a risk of being too slow if overseas interest rate environments shift.

Monitoring Market Volatility: Members expressed attention to recent one-sided steepening in the government bond (JGB) yield curve and increased market volatility. The Bank should respond flexibly to ensure market functioning while reducing its JGB purchases as planned.

Government's Stance: Representatives from the Ministry of Finance and Cabinet Office urged the Bank to conduct appropriate policy to achieve the 2% target sustainably, emphasizing close cooperation between the government and the central bank.