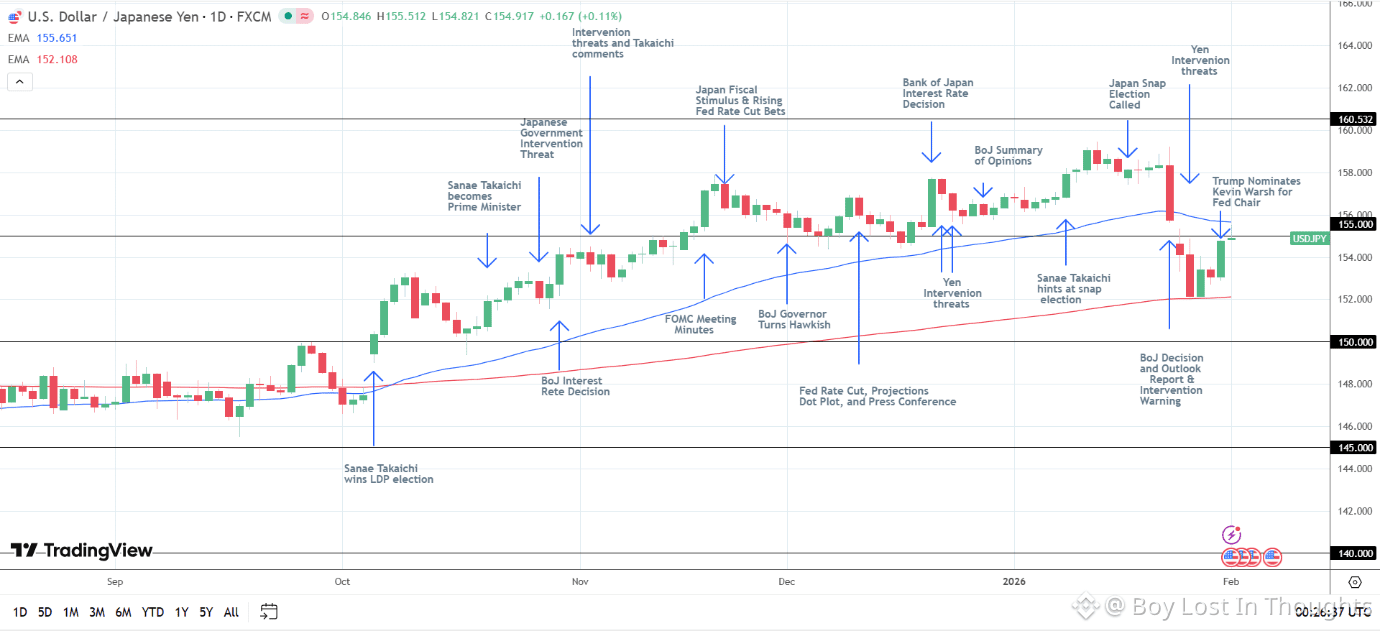

The Japanese Yen is gaining strength against the U.S. Dollar, driven by a hawkish shift in the Bank of Japan's policy stance. With BoJ policymakers eyeing a potential rate hike in early 2026 and the Fed expected to cut rates later that year, the interest rate gap between the two countries is shrinking—fueling Yen demand. Technically, USD/JPY has turned bearish, trading below key moving averages and threatening a deeper decline. While upcoming elections in Japan and U.S. economic data pose short-term risks, the broader outlook favors Yen appreciation, with longer-term targets extending toward 140.

Key Points :

BoJ Turns Hawkish: The Bank of Japan’s latest Summary of Opinions signaled growing momentum for an interest rate hike in the first half of 2026, boosting demand for the Yen and pressuring USD/JPY lower.

Policy Divergence Narrows: Upward revisions to Japan’s GDP and inflation forecasts, alongside expectations of multiple Fed rate cuts in 2026, are narrowing the U.S.-Japan interest rate differential—a key bearish driver for USD/JPY.

Technical Breakdown Underway: USD/JPY has broken below its 50-day Exponential Moving Average (EMA) and is eyeing the 200-day EMA. A sustained fall below this level could trigger a deeper drop toward 150, and possibly as low as 146.585.

Data Sensitivity Heightened: Recent price swings show USD/JPY is highly reactive to Japanese economic indicators (inflation, retail sales) and U.S. data, especially those influencing Fed rate cut expectations, such as the ISM Manufacturing PMI.

Long-Term Risks Favor Yen Strength: A potentially higher BoJ neutral interest rate (1.5%-2.5%) could lead to multiple hikes, possibly triggering an unwind of Yen carry trades and pushing USD/JPY toward 140 over a 6–12 month horizon.

Upside Limited: Any USD/JPY rallies face a strong cap near 155, due to the threat of Japanese FX intervention and the overarching bearish fundamental backdrop.