Bitcoin is facing a significant test after its worst weekly performance in nearly a year. The key focus is whether it can maintain support around the $75,000 level amidst a barrage of macroeconomic risks. These include critical U.S. jobs data, major tech earnings reports, and looming fears of a government shutdown. Furthermore, the Federal Reserve's stance against imminent interest rate cuts, reinforced by hotter-than-expected inflation data, continues to dampen risk appetite and act as a headwind for cryptocurrency prices. The strengthening U.S. dollar adds another layer of pressure, with technical indicators suggesting the potential for further decline unless a short-term bounce materializes.

Key Points :

Severe Weekly Drop: Bitcoin just had its worst weekly loss since March 2025, down nearly 11%.

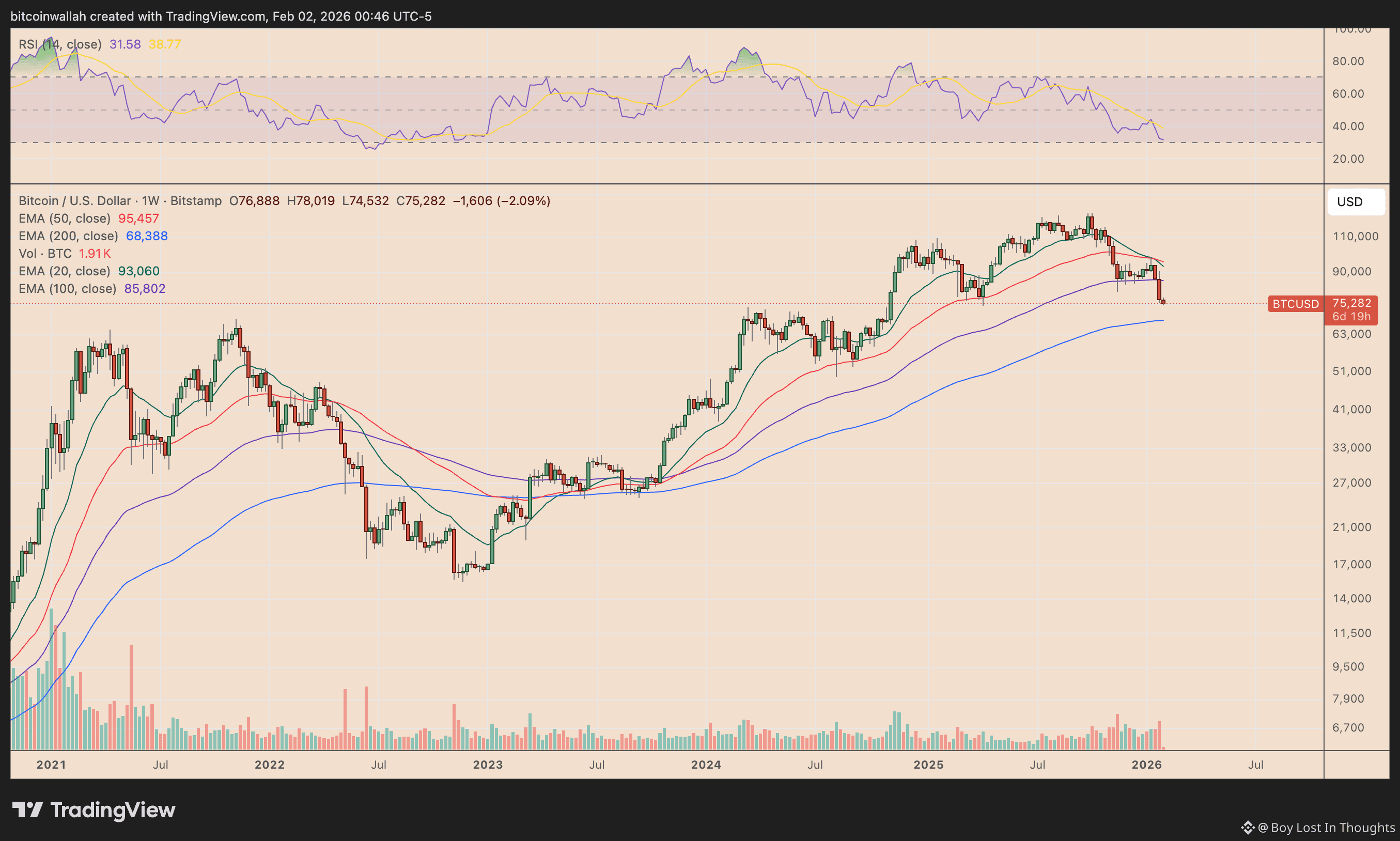

Critical Support Zone: The price is testing a crucial support area between $74,500 and $76,500, a previous springboard for major rallies.

Macro Storm Brewing: Three major risk events converge:

The U.S. monthly jobs report.

High-stakes earnings from mega-cap tech (Alphabet, Amazon, AMD).

Threat of a U.S. government shutdown.

Fed as a Headwind: The Federal Reserve shows no urgency to cut rates, and hot PPI data confirms persistent inflation, reducing risk appetite.

Dollar Strength Hurts: A rising U.S. Dollar Index (DXY) is negatively impacting Bitcoin and crypto markets.

Technical Outlook: The daily chart shows oversold conditions that could fuel a short-term bounce, especially if tech earnings boost sentiment. However, the weekly chart suggests a more aggressively bearish trend, with a potential pullback toward the 200-week EMA near $68,000 as part of a historical four-year cycle pattern.