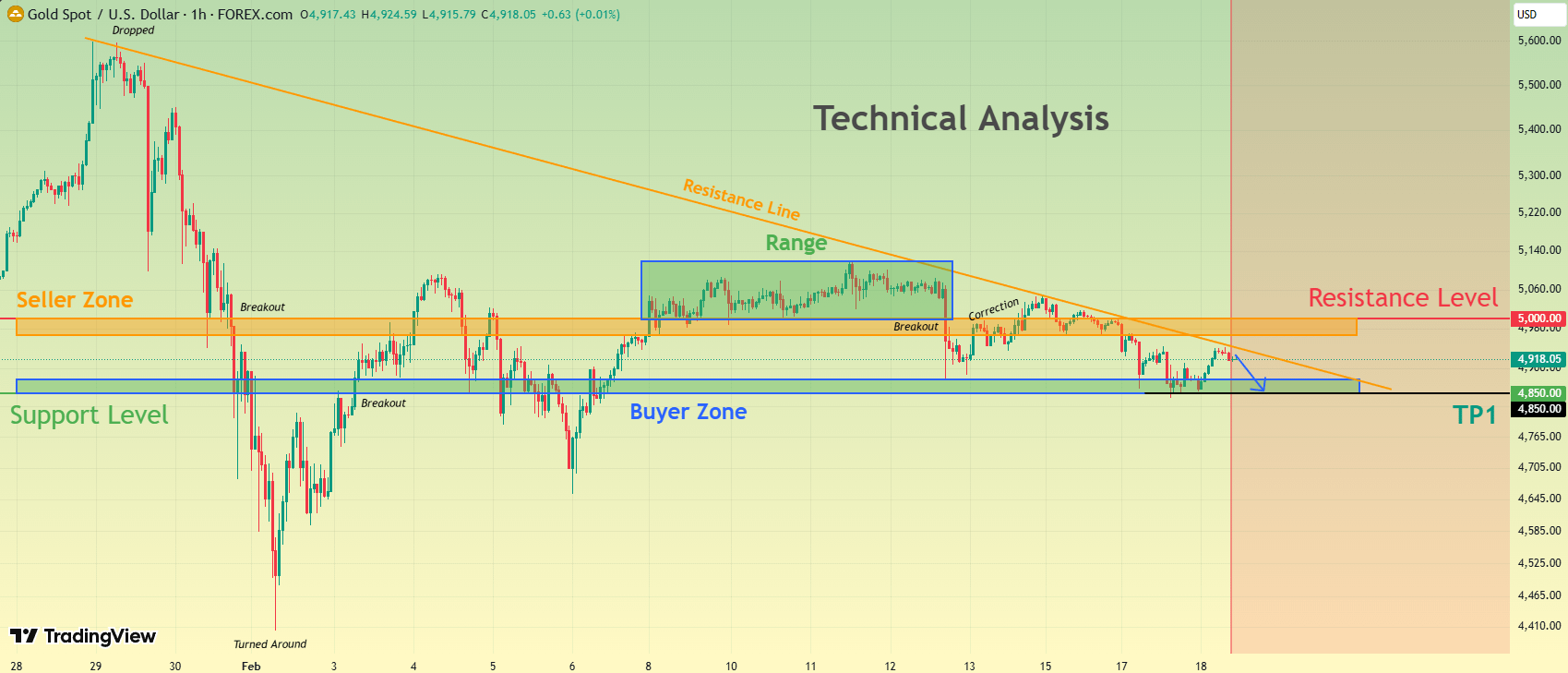

Here’s my technical outlook on $XAU USD (1H) based on the current chart structure. Gold recently experienced a strong impulsive drop from the highs, where price failed near a clear swing top and sellers stepped in aggressively. This move shifted short-term momentum bearish and drove price back toward the previously established Seller Zone, which acted as a key structural level during the decline. After breaking below this zone, gold continued lower and eventually reached the major Buyer Zone around the support level, where selling pressure started to fade and buyers began to react. From this demand area, price staged a recovery move, pushing back toward the mid-range of the structure. However, instead of transitioning into a new bullish trend, gold entered a consolidation phase. The market formed a clearly defined range beneath the descending resistance line, showing that buyers lacked sufficient momentum to reclaim higher levels. This behavior indicates controlled correction rather than a true trend reversal. Currently, $XAU USD is trading below the descending resistance line and just under the Resistance Level near 5,000, while holding above the Buyer Zone around 4,850. Price action shows compression between horizontal support and dynamic resistance, suggesting that the market is building pressure for the next directional move. The repeated failure to sustain above resistance increases the probability that the range represents distribution rather than accumulation. My primary scenario favors bearish continuation as long as gold remains below the descending resistance line and the 5,000 Resistance Level. A rejection from current levels or from a retest of resistance could trigger another downside leg toward the 4,850 Buyer Zone (TP1), which represents the nearest liquidity and reaction area. A decisive breakdown and acceptance below this support would expose deeper downside levels and confirm continuation of the bearish structure. However, a clean breakout and sustained acceptance above the resistance line and the 5,000 level would invalidate the bearish scenario and suggest a broader bullish recovery. Until such confirmation appears, price behavior and structure continue to favor sellers, with rallies viewed as corrective moves inside a bearish framework.

TRADE $XAU HERE 👇

#GOLD #TrendingTopic #BTCVSGOLD